- Taiwo Oyedele, the Chairman of the Presidential Committee on Tax Reforms, explained that Nigeria’s new tax-intelligence system will track major tax evasion by analyzing various aspects of a person’s financial life, including bank transactions, travel, utility use, and phone activity.

- He assured that the system will focus on high-level fraud, not low-income earners or minor spending inconsistencies.

- Oyedele warned that under the new tax law, which takes effect next year, individuals with significant, unexplained tax discrepancies face having their bank accounts debited if they cannot justify their financial activities.

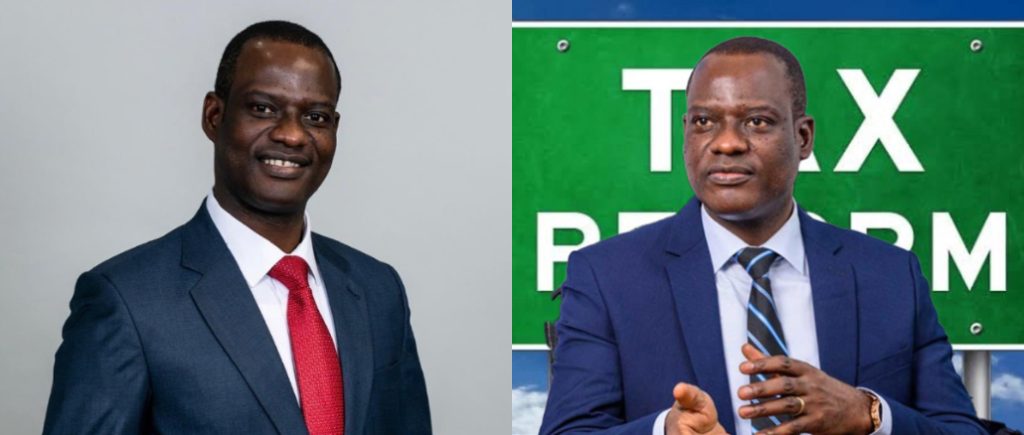

Taiwo Oyedele, the Chairman of the Presidential Committee on Tax Reforms, has offered a stern warning to major tax evaders, detailing how the government’s new tax-intelligence system will track undeclared wealth and enforce compliance.

Speaking on The Micon Podcast, Oyedele explained that the upcoming framework, set to take effect next year, will eliminate old-style harassment by using advanced data analysis to identify high-level fraud.

Tracking the Financial Footprint

Oyedele stated that the new system will aggregate a person’s financial life to create an accurate tax profile. This will involve analyzing data across several points:

Bank transactions

International travel records

Payment card usage

Electricity consumption

Phone activity

He clarified that the system is not designed to target low-income earners, stressing: “No one is coming after you if you earn 50 thousand and spend 90 thousand. That’s not the focus. The real target is the big figures.”

Direct Debit for Defaulters

The Tax Chairman warned that once the intelligence system identifies significant, unexplained financial movements, the taxpayer will be expected to justify the discrepancy. Under the new tax law, failure to explain a tax shortfall can lead to direct enforcement.

Oyedele issued the stark warning:

“IF YOU CANNOT EXPLAIN YOURSELF, IF YOU HAVE A BANK ACCOUNT, WE CAN DEBIT YOUR BANK ACCOUNT.”

He further emphasized: “If the system confirms you owe one million naira in taxes and you can’t explain it, we can debit your bank account.”

This new model, according to Oyedele, is a move away from aggressive, old-fashioned enforcement, as the country is shifting from “using hammers and nails to cha§e people for tax” to a more professional, data-driven approach.

![“How can you tell me I can only withdraw N1000?” – Man wearing only boxers creates scene inside bank, Nigerians react [Video]](https://www.gistlover.com/wp-content/uploads/2023/02/man-bank-boxers.jpg)

Leave a Reply