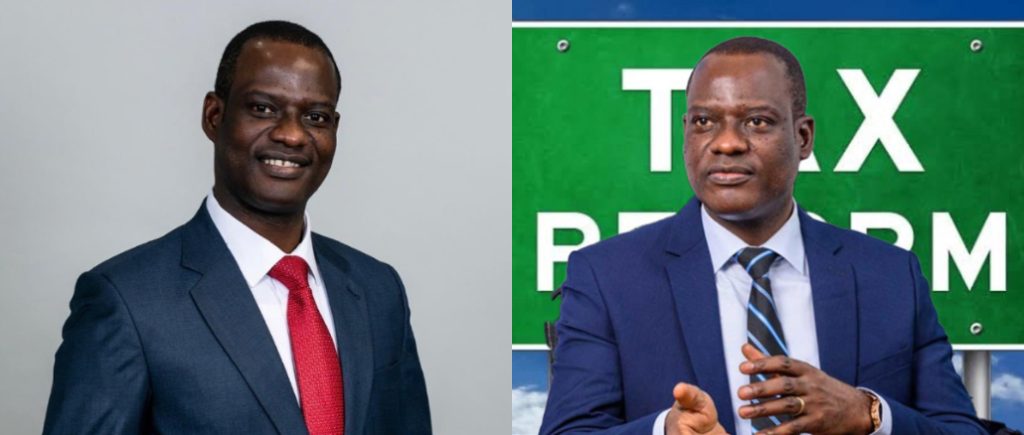

- Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has urged Nigerians to file their annual tax returns, warning that compliance remains very low.

- Speaking at a webinar, he stressed that both employers and employees must file returns, even when taxes are deducted at source, and reminded taxpayers that the deadline is March 31.

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has urged Nigerians to comply with the law by submitting their annual tax returns, stressing that the obligation applies to both employers and individual taxpayers.

Oyedele made the call during a webinar organised for HR managers, payroll officers, chief financial officers, and tax managers, in collaboration with the Joint Revenue Board. The webinar was posted on YouTube on Friday.

Addressing participants, he noted that many Nigerians remain non-compliant with filing self-assessment tax returns.

“In terms of filing returns, you need to file annual returns as employers for your employees. Many of you must have done that already. If you haven’t, you have just a couple of days left to file those returns, including projections of how much you will pay your staff,” he said.

He added that individuals are also required to file their own tax returns, regardless of whether their taxes are deducted at source.

“This is one area where we have been non-compliant in Nigeria. In many states, more than 90%—even the most sophisticated states cannot boast of 5% filing returns,” Oyedele said.

According to him, employees should not assume their obligations end once their employers deduct taxes from their salaries.

“Many people assume that if they are an employee and the employer has deducted pay, they don’t have to do anything. That is wrong. Both under the old and new tax laws, you must still file your returns,” he stressed.

Oyedele assured Nigerians that tax authorities are working to simplify the filing process.

“I’m sure the tax authorities, joint revenue boards, and various state internal revenue services are working on how to make this process simpler and easier. All of us must file our returns, including those earning low income. You must file returns by 31st March of the year in respect of the previous fiscal year,” he said.

He also disclosed that under the new tax laws, businesses benefiting from tax incentives are now required to declare such incentives when filing their returns.

“Under the new tax law, if you operate a business as an enterprise and you enjoy certain incentives, you have the obligation to disclose those incentives. There’s a disclosure requirement for tax incentives that is not available to everybody as a general rule for taxpayers to disclose them when filing their tax returns or shortly after,” Oyedele added.

Leave a Reply